Maximize Your Profits with Trading Forex Robots

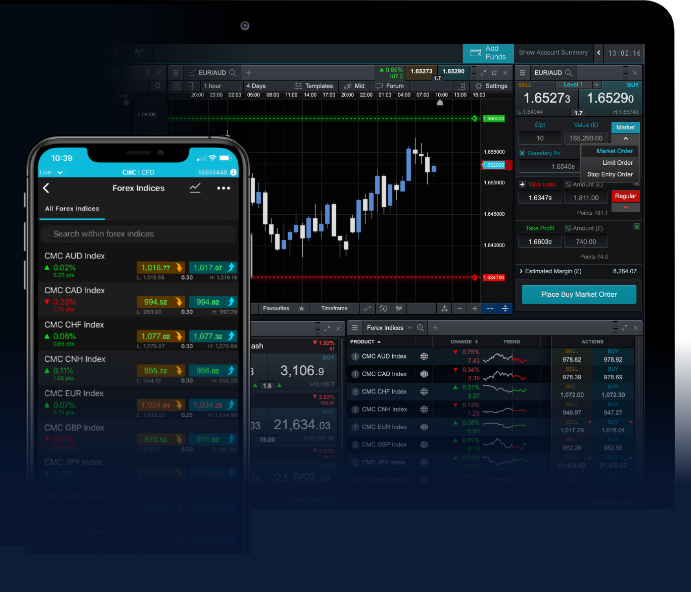

In today’s fast-paced financial markets, the quest for effective and efficient trading strategies is never-ending. Among the tools that traders have at their disposal, trading forex robot Global Web Trading has highlighted the increasing popularity of trading forex robots. These automated systems are designed to analyze market trends, execute trades, and manage risks in a way that often surpasses human capabilities. In this article, we will explore what forex robots are, how they work, their advantages and disadvantages, and how to choose the best one for your trading needs.

What are Forex Robots?

Forex robots, often referred to as expert advisors (EAs), are automated trading systems that operate on the forex market. They are programmed using algorithms that are designed to analyze historical market data and execute trades based on predetermined criteria. Traders use these software programs to take advantage of market opportunities in real time without needing to monitor the market constantly.

How Do Trading Forex Robots Work?

The functionality of a trading forex robot hinges on several key components:

- Algorithms: At the core of every forex robot is a sophisticated algorithm that dictates its trading strategy. This algorithm is programmed to recognize patterns, trends, and signals that indicate a favorable trading opportunity.

- Market Analysis: Forex robots continuously analyze market data, including price movements, volume, and other indicators. This analysis allows them to make informed decisions about when to buy or sell currency pairs.

- Execution of Trades: Once a trading opportunity is identified, the robot automatically executes the trade based on predefined settings, which can include stop loss and take profit levels.

- Risk Management: Effective forex robots include risk management parameters to minimize potential losses. This can involve setting limits on the size of trades or using trailing stops to secure profits.

Advantages of Using Forex Robots

Utilizing forex robots comes with several advantages:

- Emotional Trading Reduced: By automating trades, forex robots eliminate the emotional elements that often lead to poor decision-making. Traders are less likely to let fear or greed dictate their actions.

- 24/7 Market Monitoring: Forex robots can operate around the clock, ensuring that trading opportunities are never missed, even when the trader is unavailable.

- Backtesting Capabilities: Many forex robots provide the ability to backtest strategies using historical data. This helps traders understand the effectiveness of a strategy before committing real money.

- Consistency: Robots follow their programmed strategies without deviation, allowing for consistent trading approaches that align with the trader’s goals.

Disadvantages of Forex Robots

Despite their many advantages, forex robots also come with certain drawbacks:

- Technical Issues: Like any software, forex robots are prone to bugs and glitches. A technical failure can result in unexpected losses.

- Market Conditions: Forex robots may not adapt well to changing market conditions. What works in a trending market may not work in a ranging market, potentially leading to losses.

- Over-Optimization: Traders might fall into the trap of over-optimizing their robot for past performance, which does not guarantee future success. It’s crucial to strike a balance between optimization and realism.

- Cost: Many reputable forex robots come with a price tag, which can be a barrier for budding traders. Additionally, ongoing subscription fees can add up over time.

How to Choose the Right Forex Robot

Choosing the right forex robot is a critical step in ensuring success in automated trading. Here are some tips:

- Determine Your Trading Goals: Before selecting a robot, clarify your trading objectives, including your risk tolerance and investment horizon.

- Research Performance: Look for verified performance results from independent sources. This can provide insight into the robot’s success rate and drawdown levels.

- Read Reviews: User testimonials and reviews can offer valuable information regarding a robot’s reliability and effectiveness.

- Trial Periods: Many forex robots offer trial periods. Take advantage of these to test the robot and see how it aligns with your trading style.

- Support and Community: A strong support system and an active community can help resolve issues and share insights on optimizing the robot’s performance.

Conclusion

The world of forex trading is complex and ever-evolving. Trading forex robots serve as valuable tools that can enhance a trader’s ability to seize opportunities and manage risks effectively. While they offer numerous benefits, it’s essential for traders to remain cautious and informed. By understanding the mechanics behind forex robots and choosing wisely, traders can maximize their chances of success in the challenging forex market.

In summary, trading forex robots can be a powerful addition to your trading toolkit. However, knowing how they work, their pros and cons, and how to select the right one will help you navigate your trading journey more effectively.